is nevada tax friendly for retirees

The first places to consider as your retirement home are likely the states that do not impose an income tax at all. Ad Looking for retirement communities in nevada.

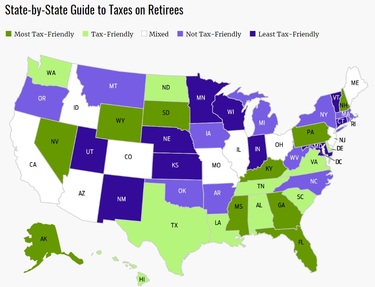

These Are The Best And Worst States For Taxes In 2019

Nevadas statewide sales tax.

. However Arizona is more affordable than Nevada. In both states the cost of living is rather expensive for retirees as both are higher than the national average. Check out the 10 Best Places to Live in Nevada.

Tax friendly states charge fewer taxes that might apply to retirees like income tax capital gains tax property tax and sales tax. Since Nevada does not have a state income tax any income you receive during retirement will not be taxed at the state level. This includes income from both Social Security and retirement accounts.

Browse the Internet and you may also see Illinois Mississippi Pennsylvania and the state of Washington on some most tax-friendly lists. States like Alaska Floriga Georgia and Nevada are some of the tax-friendliest for retirees. Interested in retiring in Nevada.

Lets address the most significant item first. Nevada also known as The Silver State is situated in the Western region of the United States with a population of roughly 308 million. As a result for many these nine states are the most tax-friendly for retirees.

Nevada is also more tax-friendly for retirees. Cost of Living in Nevada vs. COST OF LIVING FOR RETIREES.

Alaska Florida Nevada South Dakota Tennessee Texas Washington and Wyoming. Currently there are seven states with no tax on income. Find content updated daily for retirement communities in nevada.

TAX RATING FOR RETIREES. Then below the map link to more content about state taxes on retirees including our picks for the 10 most tax-friendly and the 10 least. What taxes do you pay in Nevada.

Only 16 miles from the Las Vegas strip Henderson is a great place to retire if you want suburban life only a short drive from the action. Low property tax is especially important for many retirees who may live in larger homes but have limited income streams. AL has state taxes ranging from 4 - 75 and property taxes that are some of the lowest in the country at 04 - they also offer a homestead exemption for seniors age 65 and older which may cover up to 100 of state property taxes.

Florida 24 Nevada 9 New Hampshire 49 South Dakota 35 Tennessee 15 Texas 45 and Wyoming 10. 10 above the national average. Other retirement income is taxed as regular income ranging from 2 to 5.

On the other hand California does have its own set of advantages including the ocean and beaches. Social Security income is not taxed. Is Nevada tax-friendly for retirees.

The cost of living in Nevada is up to 83 higher than in Arizona. For example in Arizona. Tax rates apply to that amount.

PER CAPITA INCOME FOR POPULATION. In addition Nevadas tax abatement law protects homeowners from sudden spikes in their property taxes. Assessed value is equal to 35 of the taxable value.

The state income tax bracket is as near to the ground as 463 and retirees can get a fair-minded presumption on retirement income. Thus if the Clark County Assessor determines your homes taxable value is 100000 your assessed value will be 35000. Nevada is extremely tax-friendly for retirees.

SHARE OF POPULATION 65.

Millions Of Americans Are Facing Uncertain Financial Futures Jobs Are No Longer Secure And Consequently Pensions O Investment Tips Investing Gold Investments

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Community

Tax Friendly States For Retirees Best Places To Pay The Least

State By State Guide To Taxes On Retirees Kiplinger Retirement Retirement Advice Tax

Monday Map State Local Property Tax Collections Per Capita Property Tax Teaching Government Map

The Most And Least Tax Friendly Us States

10 Most Least Tax Friendly States For Retirees Cheapism Com

State By State Guide To Taxes On Retirees Social Security Benefits Retirement Retirement Strategies Map Diagram

Retiree Tax Map Reveals Most Least Tax Friendly States For Retirees Senior Living Proaging News By Positive Aging Sourcebook

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

The Most And Least Tax Friendly Us States

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice

Tax Friendly States For Retirees Best Places To Pay The Least

Deciding Where To Retire Finding A Tax Friendly State To Call Home Business Wire

Nevada Tax Advantages And Benefits Retirebetternow Com

Nevada Retirement Tax Friendliness Smartasset

States Where Residents Are Most Satisfied Estate Tax Inheritance Tax Inheritance