property tax on leased car in texas

0615375 per 100 of valuation. This could include a car which in most households is a relatively valuable property.

Property Tax On A Leased Vehicle O Connor Property Tax Experts

For tax year 2014 the tax rate was 0615375 per 100 of valuation.

. The 2020 census revealed that the Texas population had grown by 16 or 4 million people in the preceding decade. 25000100 0615375 15384 Conversely you can back into the vehicles value from the tax amount by dividing the tax. How Are Car Leases Taxed In Texas.

Six dollars is due to the lessor. For used motor vehicles rented under private-party agreements an amount based on 80 percent of the SPV is taxable. Property tax rate applied to the value of vehicle.

The vehicle may be registered in the lessors name and still qualify for the new resident tax as long as the new resident is named as the lessee under the lease agreement. So for example for a vehicle valued at 25000 the tax is calculated as. Property taxes on the vehicle are not applicable for the lessee.

Journeys readers notebook grade 1 volume 2 pdf. The Texas Legislature has passed an exemption of leased vehicles primarily used for non-business personal purposes. Personal property sat on leased vehicles in texas The sales tax varies by state 25 in Tx and is dad the price less trust value alongside a trade review I filled out whatever form.

5 Things To Know About Texas Business Personal Property Tax. New homes orlando under 200k. Personal Property Tax on Leased Vehicles Background Prior to January 2 2001 Texas cities received personal property taxes on leased vehicles.

When I leased my vehicle I filled out the affadavit that states I should not be charged property taxes because the vehicle is for personal use not for business. Usually when you sign the lease the terms state what you are responsible for. In other states generally only the monthly lease payments are taxed similar to the new law in Illinois.

In most states you only pay taxes on what your lease is worth. No tax is due on the lease payments made by the lessee under a lease agreement. However each municipality city reserves the right to levy and assess ad valorem taxes on leased motor vehicles.

3805 Adam Grubb Drive Lake Worth Texas 76135-3509 Phone. Since leased vehicles produce income for the leasing company and are taxable to the leasing company. In order to meet the property tax codes definition of income-producing a vehicle must drive more than 50 percent of its miles for activities that involve the production of income within a tax year.

The tax is levied as a flat percentage of the value and it varies by county. In Texas all property is taxable unless exempt by state or federal law. Texas has one of the highest property tax rates in the country with most properties seeing substantial tax increases year over year.

Do I owe tax if I bring a leased motor vehicle into Texas from another state. Credit will be given for any tax the lessor or the lessee paid to. The standard tax rate is 625 percent.

Symbols of betrayal in dreams. Property taxes on the vehicle are not applicable for the lessee. Another word for pick up and drop off.

The exemption applies to. Debbie Whitley ACMFinance Director SUBJECT. Property tax on leased car in texas.

These vehicles include passenger cars or trucks with a shipping weight of not more than 9000 pounds and leased for personal use. Leased Vehicles for Personal Use Leased vehicles produce income for the leasing company and are in turn taxable to the leasing company. Do You Have to Pay Property Tax on a Leased Vehicle.

In Texas only income-producing tangible personal property is subject to personal property tax. Lets say you leased a BMW 320i sales price is 33000 and your lease over 27 months totals 10000 Dollars then youd be responsible for sales tax of 625 on 10000 or 62500. Hyundai santa fe console buttons.

When a vehicle is leased in another state and the lessee brings it to Texas for public highway use the lessee as the operator owes motor vehicle use tax based on the price the lessor paid for the vehicle. The major factor that distinguishes these plans is by how they are treated for tax purposes. Pratt pullman district food.

In Texas all property is considered taxable unless it is exempt by state or federal law. In February I was charged 496 which is the amount quoted for the entire term of the lease if I was to be charged which Im not supposed to have been. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle.

If personal property taxes are in effect you must file a return and declare all nonexempt property as well as its value. Fit to fat to fit jason cause of death. Texas does not tax leases.

Texas is the only state that still taxes the capitalized cost of a leased vehicle. If a new Texas resident brings a leased motor vehicle into Texas the new resident owes the 90 new resident tax. In many leasing contracts companies require their lessees to reimburse them for taxes assessed on the vehicles.

Two general types of lease plans are available. All personal use vehicles are exempt from county and school taxes. Texas does not tax leases.

For example in Alexandria Virginia a car tax runs 5. Fallen republic console commands. Does that mean you have to pay property tax on a leased vehicle.

Who Pays The Personal Property Tax On A Leased Car

Leasing A Car What Fees Do You Pay At The Start Of A Lease Autotrader

30 Day Eviction Notice Letter Free Printable Documents Being A Landlord Letter Templates Lettering

Kurz Group Blog Texas Vehicle And Business Personal Property Tax

Returning A Leased Car After An Accident Benson Bingham

Is It Better To Buy Or Lease A Car Taxact Blog

Hyundai Lease Return Center In Houston North Freeway Hyundai

Short Term Car Leases Vs Long Term Car Rentals Lendingtree

What To Do When Your Car Lease Ends Usaa

What To Know If You Have An Accident In A Leased Vehicle Freeway Insurance

Insuring A Leased Vehicle Bankrate

Who Pays The Personal Property Tax On A Leased Car

Is It Better To Buy Or Lease A Car Taxact Blog

Is It Better To Buy Or Lease A Car Taxact Blog

Free Standard Residential Lease Agreement Template Word Pdf Eforms

Who Pays The Personal Property Tax On A Leased Car

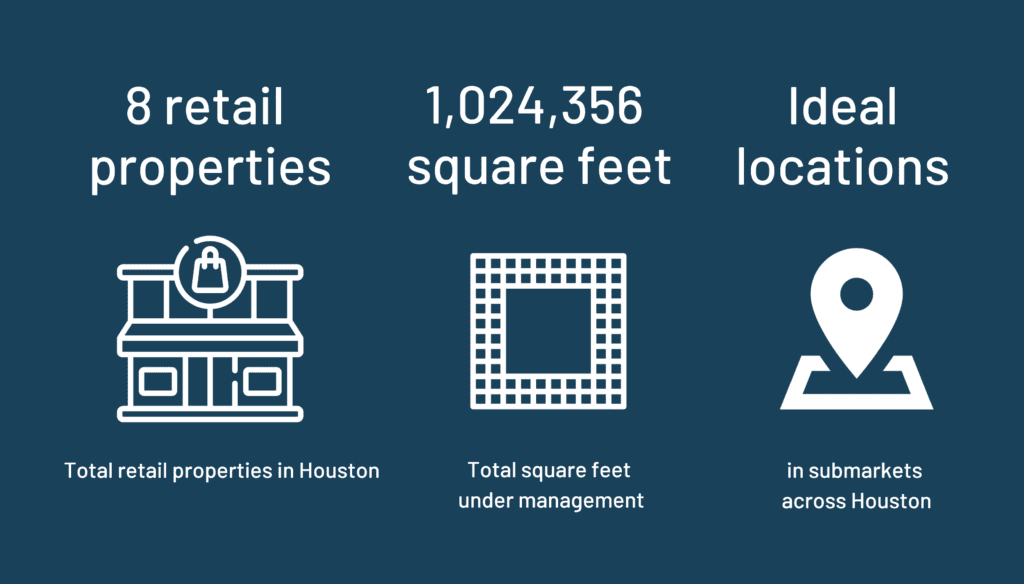

Retail Space For Lease In Houston Texas Hartman

What Questions You Should Ask About Your Lease Nbc 5 Dallas Fort Worth